Local Bank Payment Gateways Sri Lanka, What You Need To Know

Hello everyone, E-commerce startups seem like a really popular thing these days. Now plenty of people can tell you how to set up a great site, but they’re two things any e-commerce site needs a payment gateway and a working search function. The search hasn’t been solved yet. As of the time of writing, Ikman’s search is horrible, and everything else is only marginally better despite efforts, most e-commerce teams tell us that they just don’t have the amount of R&D they need to come up with good search and suggestion algorithms. We can, however, help out with the payment gateways.

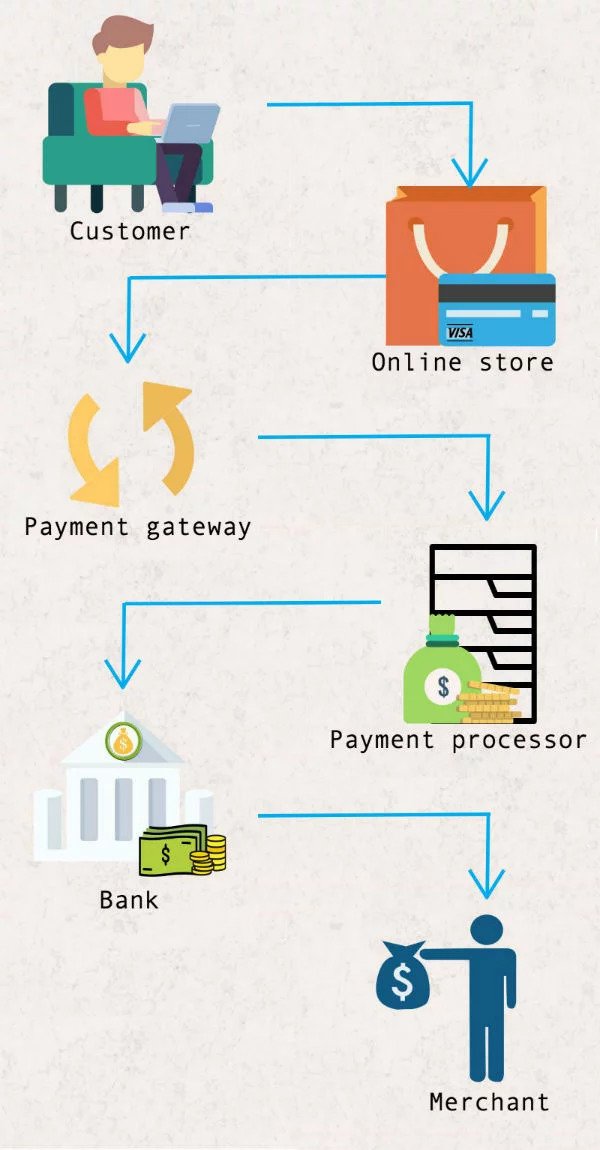

What is a payment gateway?

A payment gateway is something that authorizes you to take credit card payments. For an e-commerce firm, it’s the digital equivalent of one of those card-swipe machines that you get in stores. You make an SSL connection to a server somewhere, and voila, the money goes where it needs to be.

Since credit cards are issued by banks, and the payment back and forth are also handled by banks, it makes sense that payment gateways, too, are provided by banks. Unfortunately, there’s no such thing as a free lunch. There was a time when payment gateways used to be hideously expensive. Now things have gone down quite a bit, but you still have to pay. We called up a couple of banks – Seylan, Sampath, Commercial Bank and Nations Trust, HNB – for their rates, and here’s the breakdown. Sri Lanka payment gateway chargers.

ROUND ONE

1) BANK CARDS

The first concern is: what cards does the gateway support? It’s pretty useless if you end up with a fairly rare card as opposed to the more popular Visa and Mastercard. Thankfully, almost every bank supports all cards. Except for Nations Trust, which accepts only AMEX cards: given the fact that the majority of Sri Lankan customers run almost entirely off VISA cards, this puts NTB out of the running.

2) INITIAL COST ( SETUP FEE )

Every bank will charge you a for fixed sum to start off with Commercial Bank – Rs 75,000, varying depending on need and customer – as of the time and writing, we haven’t gotten any system of predicting how this fluctuates. Seylan Bank – Rs 20,000/- Sampath Bank – Rs 15,000/- So, HNB Bank – We haven’t their prices yet, as far as the initial cost goes: Sampath is clearly cheaper. Arguably, it’s not a massive gap between Sampath and Seylan, though it’s curious that such a high gap exists with Commercial Bank. Remember that NTB is out of the running due to their AMEX-only dependency.

3) GATEWAY MAINTENANCE FEE

Buying a gateway isn’t enough. Like a domain name, payment gateways come with recurring fees, usually annually. Commercial Bank – Rs 90,000 Seylan Bank – Rs 30,000 Sampath Bank – Rs 60,000 This is a massive difference. As you can see, there are huge, 30,000-rupee gaps between the banks. Off the bat, this radically changes our assumptions of the cheapest way of doing things. Let’s do the math

| Bank Name | Cost of running for the first year | Cost of running for two years |

| Commercial Bank | 75,000 + 90,000 = 165,000 | 165,000 + 90,000 = 255,000 |

| Seylan Bank | 20,000 + 30,000 = 50,000 | 50,000 + 30,000 = 80,000 |

| Sampath Bank | 15,000 + 60,000 = 75,000 | 75,000 + 60,000 = 135,000 |

As you can see, the differences are huge. Why these differences exist we’re not entirely certain, but we’ll explore more factors down the line to see if we can make sense of the math or declare a clear winner. At any rate, we’ve highlighted the cheapest option (Seylan), which wins this round, in our opinion, by a huge margin. Given the rates at which the costs stack, a 5 or 10-year projection only makes Seylan look astronomically cheap compared to the competition.

| Bank Name | Cost of running for the third year | Cost of running for four years |

| Commercial Bank | 255,000 + 90,000 = 345,000 | 345,000 + 90,000 = 435,000 |

| Seylan Bank | 80,000 + 30,000 = 110,000 | 110,000 + 30,000 = 140,000 |

| Sampath Bank | 135,000 + 60,000 = 195,000 | 195,000 + 60,000 = 255,000 |

ROUND TWO

4) COMMISSIONS AND DEPOSITS

Now we must consider the other costs of maintaining a payment gateway, as well as the security deposit. Gateways charge a percentage of each transaction. Both Sampath and Seylan banks charge a fixed 3% commission on each transaction. Commercial charges 4% (we were told that this varies, though the exact range is unknown). Most banks seem to require a minimum fixed deposit of Rs 100,000, except in the case of Seylan Bank, which requires a deposit of Rs 300,000. Sadly, NTB would actually have been very useful here – no deposit needed – but they’re out of the running given that they support only AMEX.

All banks also require you to have an account at that particular bank, and once the gateway is bought and paid for, you get tech support, shared servers, and a setup time of 2-3 weeks (the exception is Commercial Bank, which promises a setup time of 1-2 weeks).

5) VERDICT

Given all of the above, we can see a fairly clear-cut choice: Seylan. While the initial fixed deposit is 3x that of other banks, the math works out overwhelmingly in its favor, especially if your business plan stretches into years. Commercial Bank’s faster setup time is to its credit, but fails to justify the high setup and higher maintenance fees. Sampath has the credit of being the cheapest to start with, but its high maintenance costs negate that advantage early on. Extra research is always warranted, as this is a preliminary scan; in your choice, make sure to factor in service, efficiency and technical factors – especially how much headspace the shared servers actually give you. These needs, of course, will change depending on you and your business. We’ve given you a heads-up – hopefully, this helps when making your choice.